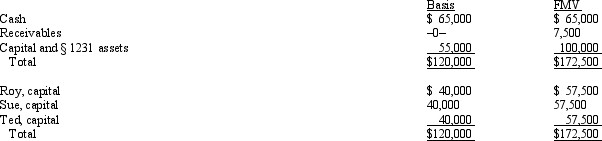

The December 31,2010,balance sheet of the RST General Partnership reads as follows.

The partners share equally in partnership capital,income,gain,loss,deduction and credit.Ted's adjusted basis for his partnership interest is $40,000.On December 31,2010,he retires from the partnership,receiving a $60,000 cash payment in liquidation of his interest.The partnership agreement states that $2,500 of the payment is for goodwill.Which of the following statements about this distribution is false?

Definitions:

Proposals

Reports that combine information delivery and persuasive communication.

Three-Step Writing Process

A structured approach to writing that includes planning, writing, and completing to ensure effective communication.

Analytical Report

A document that provides detailed analysis on a specific topic, using data and research to support conclusions.

Effective Report

A document that clearly and efficiently communicates information and findings to its intended audience.

Q16: If the partnership properly makes an election

Q21: Verstehen refers to a technique for studying

Q33: Which statement is incorrect?<br>A)S corporations are treated

Q42: Income from patents can qualify for capital

Q51: Fern,Inc. ,Ivy Inc. ,and Jason formed a

Q69: C corporations and S corporations can generate

Q82: Tina and Randy formed the TR Partnership

Q88: Your client is a C corporation that

Q103: Marcus contributes property with an adjusted basis

Q119: Steve and Karen are going to establish