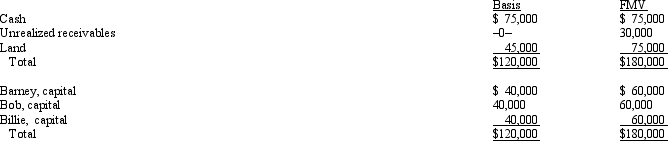

Barney,Bob,and Billie are equal partners in the BBB Partnership.The partnership balance sheet reads as follows on December 31 of the current year:

Partner Billie has an adjusted basis of $40,000 for her partnership interest.If Billie sells her entire partnership interest to new partner Janet for $60,000 cash,how much capital gain and ordinary income must Billie recognize from the sale?

Definitions:

Job Specialization

The process of focusing one's occupation on a narrow set of tasks or skills, often to increase efficiency and expertise.

Task Identity

The extent to which a job involves completing a whole and identifiable piece of work, giving the worker a sense of accomplishment.

Task Significance

The degree to which a job has a substantial impact on the lives or work of other people within or outside the organization.

Performance Feedback

Information provided to individuals or groups regarding their performance or behavior with the intention to improve their effectiveness or efficiency.

Q9: Outline the requirements that an entity must

Q13: In a proportionate liquidating distribution,Barbara receives a

Q21: What impact has the community property system

Q58: All exempt organizations which are subject to

Q66: What did Project Camelot deal with?<br>A) student

Q76: Describe this same research study in terms

Q82: Which of the following requirements are among

Q84: Discuss some ways one might go about

Q95: Kevin,Chuck,and Greg contributed assets to form the

Q96: The study of research methods primarily has