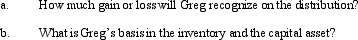

In a proportionate liquidating distribution in which the partnership is liquidated,Greg received cash of $20,000,inventory (basis of $2,000,fair market value of $3,000),and a capital asset (basis and fair market value of $4,000).Immediately before the distribution,Greg's basis in the partnership interest was $30,000.

Definitions:

Bill Clinton

The 42nd President of the United States, serving from 1993 to 2001, known for his economic policies, the impeachment proceedings related to his personal life, and various global initiatives.

Globalization

The process of interaction and integration among people, companies, and governments worldwide, often involving the exchange of goods, services, technology, and cultural ideas.

Democratic Tax Increases

Refers to taxation policies or proposals, typically advocated by the Democratic Party, aiming to raise taxes, often on wealthier individuals or corporations, to fund public services and social programs.

The Deficit

The financial situation in which a government's expenditures exceed its revenues, leading to borrowing and national debt.

Q3: An S corporation with substantial AEP has

Q6: Trolette contributes property with an adjusted basis

Q33: Discuss the design and execution of the

Q37: Which of the following refers to the

Q42: Dan gifts a 50% interest in his

Q44: Surina sells her 25% partnership interest to

Q48: Confidentiality of government-sponsored research is guaran- teed

Q52: _ occurs when researchers choose nonequivalent groups

Q66: The androcentric bias in criminology refers to

Q130: A business entity is always taxed the