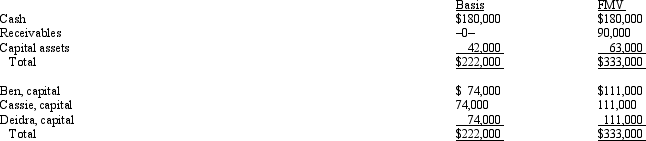

The December 31,2010,balance sheet of the BCD General Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital,income,gain,loss,deduction and credit.Capital is not a material income-producing factor to the partnership.On December 31,2010,general partner Cassie receives a distribution of $120,000 cash in liquidation of her partnership interest under § 736.Nothing is stated in the partnership agreement about goodwill.Cassie's outside basis for the partnership interest immediately before the distribution is $74,000.

How much is Cassie's recognized gain from the distribution and what is the character of the gain?

Definitions:

Electric Shocks

A sudden discharge of electricity through a part of the body, which can be painful or harmful, used in various experimental and medical treatments.

Ulcers

Open sores that develop on the lining of the stomach, small intestine, or esophagus, often causing pain and discomfort.

Appetizing Food

Food that is visually appealing and stimulates the desire to eat.

Biopsychosocial Approach

An integrated approach that incorporates biological, psychological, and social-cultural levels of analysis in understanding human behavior and illness.

Q18: The null hypothesis is the predicted expected

Q19: Repatriating prior year earnings from a foreign

Q24: Cynthia sells her 1/3 interest in the

Q30: Part of the widespread acceptance of the

Q31: Which of the following taxes are included

Q35: Compare the distribution of property rules for

Q58: Research concerned with addressing and providing solutions

Q82: The major explanation for the "crime dip"

Q109: Maurice purchases a bakery from Philip for

Q124: Joyful,Inc. ,a tax-exempt organization,leases a building and