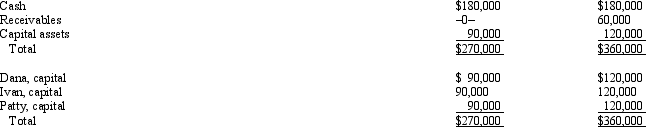

The December 31,2010,balance sheet of the DIP General Partnership is as follows:

The partners share equally in partnership capital,income,gain,loss,deduction,and credit and capital is not a material income-producing factor.On December 31,2010,general partner Dana receives a distribution of $120,000 cash in liquidation of her interest under § 736.Dana's outside basis for the partnership interest immediately before the distribution is $90,000.What is Dana's gain or loss on the distribution and its character?

Definitions:

Product Costs

The total costs associated with manufacturing a product, including direct labor, direct materials, and manufacturing overhead.

Opportunity Costs

The advantages forgone by selecting one option instead of another.

Fixed Cost

Costs that do not vary with the level of production or sales, such as rent or salaries.

Indirect Costs

Costs that are not directly traceable to a specific product or activity, such as overhead and administrative expenses.

Q10: MEM Partners was formed during the current

Q17: Determine the incorrect citation:<br>A)Ltr.Rul.20012305.<br>B)George W.Guill,112 T.C._,No.22 (1999).<br>C)Ltr.Rul.200108052.<br>D)Rev.Rul,98-32,I.R.B.No.25,4.<br>E)None

Q33: Researchers universally agree that quantitative research is

Q45: If a valuation allowance is decreased (released)in

Q50: Identify the components of the tax model

Q54: Geneva receives a proportionate nonliquidating distribution from

Q65: The National Incident-Based Reporting System requires detailed

Q77: In the diffusion of treatment effect neither

Q97: The "check-the-box" Regulations enable certain entities which

Q116: Actual dividends paid to shareholders result in