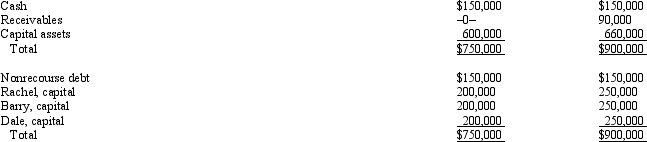

On August 31 of the current tax year,the balance sheet of the RBD General Partnership is as follows:

On that date,Rachel sells her one-third partnership interest to Bill for $300,000,including cash and relief of Rachel's share of the nonrecourse debt.The nonrecourse debt is shared equally among the partners.Rachel's outside basis for her partnership interest is $250,000.How much capital gain and/or ordinary income will Rachel recognize on the sale?

Definitions:

Arbitrary Dismissal

Termination of employment without just cause, or in violation of legal or contractual requirements.

Contract Provisions

Specific clauses or terms included in a contract that dictate the obligations, rights, and responsibilities of the parties involved.

Valid

Legally sound, effective, or binding; having a solid, cogent basis in logic or fact.

Job-related Reason

A cause or rationale directly linked to one's employment, often used in making decisions about hiring, firing, or workplace adjustments.

Q1: The Project of Human Development utilized an

Q5: Any 80% or more owned domestic subsidiaries

Q25: The group that receives the treatment in

Q28: There is a positive relationship between a

Q41: How does a treaty with a foreign

Q59: Which of the following is not a

Q73: Polsky advocates the point of view that

Q83: During 2010,an S corporation in Flint,Michigan,has a

Q83: Which of the following statements is correct?<br>A)The

Q85: Institutional Review Boards (IRBs) currently have very