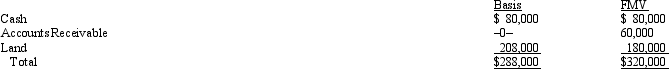

Rita sells her 25% interest in the RSTU Partnership to Nancy for $90,000 cash.At the end of the year prior to the sale,Rita's basis in RSTU was $60,000.The partnership allocates $12,000 of income to Rita for the portion of the year she was a partner.On the date of the sale,the partnership assets and the agreed fair market values were as follows.

Determine the amount and character of any gain that Rita recognizes on the sale.

Definitions:

Math Problems

Math problems are exercises requiring the application of mathematical methods and reasoning to find solutions or understand mathematical concepts.

The Bell Curve

A book that discusses human intelligence distribution in a bell-shaped curve and its implications on social and economic issues.

Welfare Dependency

A situation where individuals or families remain reliant on government assistance for long periods, potentially hindering self-sufficiency.

Low IQ

Refers to an Intelligence Quotient that is significantly below the average for an individual's age group, often indicating difficulties in intellectual functioning.

Q3: Which tax service is owned by Thomson?<br>A)Tax

Q25: Charitable contributions are subject to the 10%

Q26: Proposed Regulations issued simultaneously with Temporary Regulations

Q27: Deduction is a process of moving from

Q31: At the beginning of the year,Elsie's basis

Q31: Longitudinal studies involve the study of the

Q40: The best way of avoiding selection bias

Q47: Apple,Inc. ,a cash basis S corporation in

Q69: Joel and Desmond are forming the JD

Q71: Which of the following is correct regarding