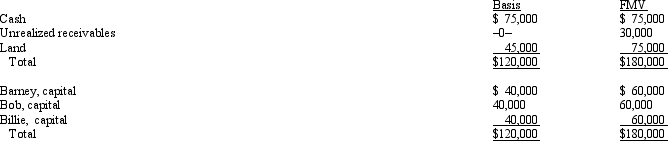

Barney,Bob,and Billie are equal partners in the BBB Partnership.The partnership balance sheet reads as follows on December 31 of the current year:

Partner Billie has an adjusted basis of $40,000 for her partnership interest.If Billie sells her entire partnership interest to new partner Janet for $60,000 cash,how much capital gain and ordinary income must Billie recognize from the sale?

Definitions:

Total Revenue

The sum of all revenue collected from selling goods or services before deducting any costs.

Marginal Cost

The monetary requirement for the generation of one additional unit of a good or service.

Average Total Cost

The total cost of production (fixed plus variable costs) divided by the total quantity of output produced. It measures the cost per unit of output.

Ceteris Paribus

a Latin phrase meaning "all other things being equal," used in economic models to isolate the effect of one variable.

Q28: Hypotheses are derived from:<br>A) theory<br>B) method<br>C) data

Q28: In the current year,Greg formed an equal

Q42: Income from patents can qualify for capital

Q46: Post hoc error is the assumption that,

Q51: What company or group publishes Supreme Court

Q53: All tax preference items flow through the

Q57: A multinational corporation has used ASC 740-30

Q76: Henry contributes property valued at $60,000 (basis

Q79: Since 1980, the most important source of

Q80: South,Inc. ,earns book net income before tax