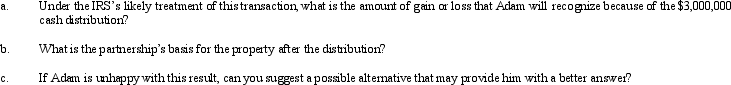

Adam contributes property with a fair market value of $3,000,000 and an adjusted basis of $1,200,000 to AP Partnership.Adam shares in $2,000,000 of partnership debt under the liability sharing rules,giving him an initial adjusted basis for his partnership interest of $3,200,000.One month after the contribution,Adam receives a cash distribution from the partnership of $3,000,000.Adam would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Adam's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Proportionate Consolidation Method

An accounting technique where an investor reports its share of an investee's assets, liabilities, income, and expenses in proportion to its ownership percentage, without consolidating the financial statements.

Consolidated Balance Sheet

A financial statement that aggregates the assets, liabilities, and equity of a parent company and its subsidiaries into one document.

Goodwill

An intangible asset that arises when a buyer acquires an existing business, representing the premium paid over the fair value of its net assets.

Proportionate Consolidation Method

An accounting technique used for combining the financial statements of joint ventures, where the investor's share of each line item is included proportionally.

Q2: Current tax expense is always the amount

Q19: The termination of an S election occurs

Q31: Which of the following taxes are included

Q33: Researchers universally agree that quantitative research is

Q42: The _ variable is the variable one

Q54: Amelia,Inc. ,is a domestic corporation with the

Q58: Which statement is incorrect about an S

Q73: The dependent variable is the variable one

Q97: Meagan purchased her partnership interest from Lisa

Q119: Passive investment income includes net capital gains