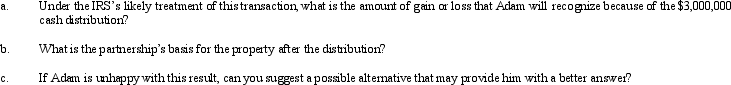

Adam contributes property with a fair market value of $3,000,000 and an adjusted basis of $1,200,000 to AP Partnership.Adam shares in $2,000,000 of partnership debt under the liability sharing rules,giving him an initial adjusted basis for his partnership interest of $3,200,000.One month after the contribution,Adam receives a cash distribution from the partnership of $3,000,000.Adam would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Adam's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Capital Expenditure

Funds used by a company to acquire or upgrade physical assets such as property, industrial buildings, or equipment to improve long-term business operations.

Gain or Loss

The financial result from a transaction where the sale price is either higher (gain) or lower (loss) than the purchase price or the book value of an asset.

Disposed Asset

An asset that has been sold, discarded, or otherwise disposed of by a company.

Book Value

Book value is the net value of a company's assets found on its balance sheet, calculated by subtracting liabilities from the total assets.

Q1: The MOG Partnership reports ordinary income of

Q8: Institutional Review Boards are formed and run

Q16: A partnership has accounts receivable with a

Q16: What advantage does a time-series design have

Q25: There is unanimous agreement that the cause

Q38: Nick sells his 25% interest in the

Q49: According to Klockars the researcher-subject model in

Q66: On January 2,2009,David loans his S corporation

Q81: Identify a disadvantage of an S corporation.<br>A)Generally,trusts

Q102: The classic experimental model is always the