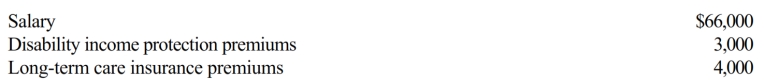

James, a cash basis taxpayer, received the following compensation and fringe benefits in the current year:

His actual salary was $72,000. He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed. The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled. The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility. What is James's gross income from the above?

Definitions:

Practices Drums

The act of regularly playing the drums to improve skill and technique.

Correctly Punctuated

Text that utilizes proper punctuation marks according to grammatical rules, ensuring clarity and readability.

Crayons

Colorful wax sticks used for drawing and coloring.

History Final

An end-of-term or end-of-course examination focusing on historical facts, theories, dates, and figures.

Q12: Subchapter C refers to the subchapter in

Q17: If an activity involves horses, a profit

Q35: Janet is the CEO for Silver, Inc.,

Q45: On March 1, 2018, Lana leases and

Q51: Post-1984 letter rulings may be substantial authority

Q61: Terri purchased an annuity for $100,000. She

Q80: How do treaties fit within tax sources?

Q92: A taxpayer can carry back any NOL

Q103: If a taxpayer operates an illegal business,

Q105: An election to use straight-line under ADS