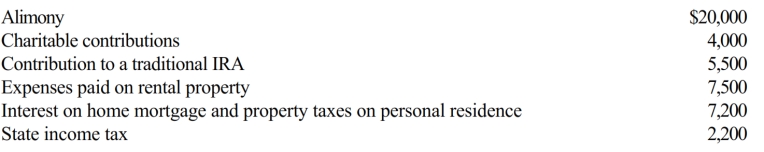

Al is single, age 60, and has gross income of $140,000. His deductible expenses are as follows:

What is Al's AGI?

Definitions:

Public Park

An open space preserved for recreational use by the public, often maintained by a city or municipality.

Duplex

A dwelling consisting of two living units with separate entrances, either side by side or on two different floors.

Lease Agreement

In regard to the lease of goods, an agreement in which one person (the lessor) agrees to transfer the right to the possession and use of property to another person (the lessee) in exchange for rental payments.

Writing

The act or process of producing texts, such as letters, documents, or creative materials, using a pen, pencil, typewriter, or computer.

Q7: Cash received by an employee from an

Q15: Iris collected $150,000 on her deceased husband's

Q29: Are there any exceptions to the rule

Q36: A loss is not allowed for a

Q50: Nikeya sells land (adjusted basis of $120,000)

Q86: Terry and Jim are both involved in

Q92: Tom, whose MAGI is $40,000, paid $3,500

Q98: For a president of a publicly held

Q102: Under MACRS, the double-declining balance method is

Q141: Under the simplified method, the maximum office