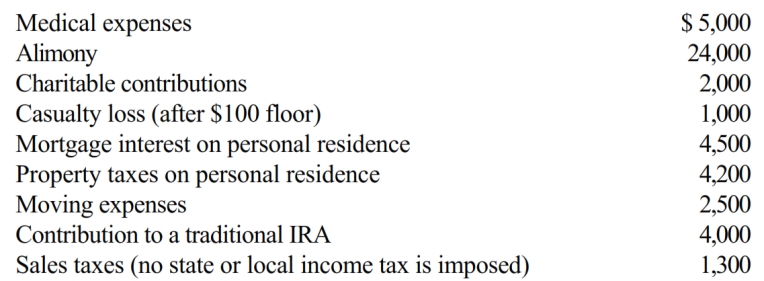

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during 2018:

Calculate Austin's deductions for AGI.

Definitions:

Dominant Traits

Genetic characteristics that are expressed in an organism even when only one copy of the gene is present.

Incomplete Dominance

A genetic phenomenon where the phenotype of the heterozygote lies somewhere between the phenotypes of the two homozygotes.

Red-Green Colorblindness

A form of color vision deficiency where individuals have difficulty distinguishing between red and green hues due to the absence or malfunction of red or green retinal photoreceptors.

Recessive Gene

A gene that produces its characteristic phenotype only when its allele is identical.

Q3: Trent sells his personal residence to Chester

Q3: Jacob and Emily were co-owners of a

Q13: Blue Corporation incurred the following expenses in

Q49: Property which is classified as personalty may

Q50: George, an unmarried cash basis taxpayer, received

Q50: A net operating loss occurring in 2018

Q55: Statutory employees:<br>A) Report their expenses as miscellaneous

Q71: The factor for determining the cost recovery

Q79: As a general rule: I. Income from

Q114: The Dargers have itemized deductions that exceed