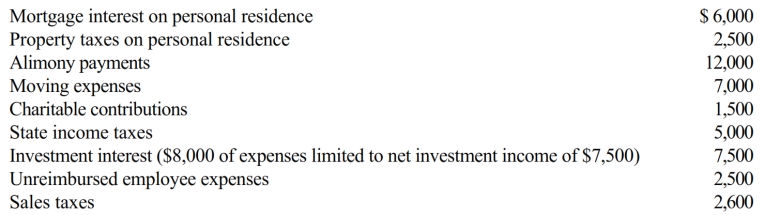

Arnold and Beth file a joint return in 2018. Use the following data to calculate their deduction for AGI.

Definitions:

Inconsistency

The quality of being irregular, erratic, or not consistent in principles, actions, or outcomes, often leading to unpredictability or conflict.

Load Factor

In the context of utilities, it's a measure of the efficiency of energy usage, calculated as the ratio of average load to the peak load in a given period.

Operating Expense

Costs associated with the day-to-day functions of a business, excluding direct production costs.

Yield

The income return on an investment, expressed as a percentage of the investment's cost.

Q5: Regarding tax favored retirement plans for employees

Q9: José, a cash method taxpayer, is a

Q16: In terms of income tax treatment, what

Q21: Flora Company owed $95,000, a debt incurred

Q26: In 2019, Rhonda received an insurance reimbursement

Q78: Mark is a cash basis taxpayer. He

Q78: Surviving spouse filing status begins in the

Q100: Janet works at Green Company's call center.

Q107: On January 1, Father (Dave) loaned Daughter

Q158: In January 2018, Jake's wife dies and