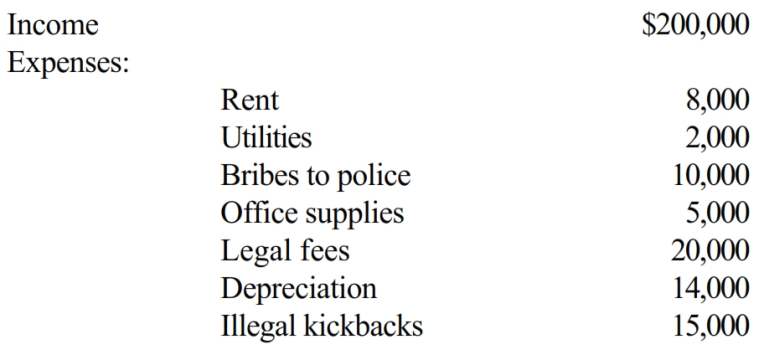

Kitty runs a brothel (illegal under state law) and has the following items of income and expense. What is the amount that she must include in taxable income from her operation?

Definitions:

Perceive

The cognitive process of interpreting and making sense of sensory information.

Environmental Invariances

Aspects of the environment that remain stable or unchanged despite transformations or changes in perspective or conditions.

Active Interpretation

The process in which individuals actively engage with and make sense of information, rather than passively receiving it.

Direct Perception

A theory that suggests individuals perceive the world directly without requiring cognitive processes to interpret sensory information.

Q20: Agnes operates a Christmas Shop in Atlantic

Q21: Petal, Inc. is an accrual basis taxpayer.

Q31: Jana has $225,000 of earned income in

Q35: Barry and Larry, who are brothers, are

Q41: A self-employed taxpayer who uses the automatic

Q82: For tax year 2018, Taylor used the

Q85: Sharon had some insider information about a

Q88: Agnes receives a $5,000 scholarship which covers

Q131: Which of the following statements is correct

Q143: Bruce owns several sole proprietorships. Must Bruce