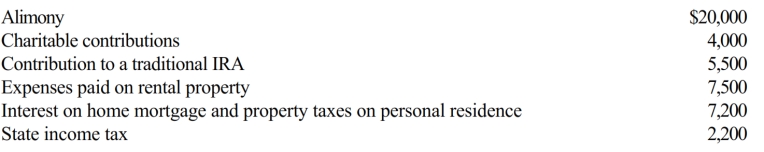

Al is single, age 60, and has gross income of $140,000. His deductible expenses are as follows:

What is Al's AGI?

Definitions:

Acute Illness

A disease or condition that comes on rapidly and is typically of short duration, often requiring urgent care.

Low Self-Esteem

A condition characterized by a lack of confidence and negative perception of oneself.

Infrequent Eye Contact

A behavioral characteristic where an individual makes less eye contact than is culturally expected, which can be interpreted in various ways depending on the context.

Low Motivation

A decreased desire or willingness to engage in activities or pursue goals, often affecting one's behavior and performance.

Q41: Lindsey purchased a uranium interest for $10,000,000

Q55: Teal company is an accrual basis taxpayer.

Q70: Mark a calendar year taxpayer, purchased an

Q85: In 2018, Morley, a single taxpayer, had

Q89: Madison is an instructor of fine arts

Q99: Married taxpayers who file a joint return

Q120: Which of the following depreciation conventions are

Q131: An uncle who lives with taxpayer.

Q134: Adjusted gross income (AGI) sets the ceiling

Q171: Age of a qualifying child