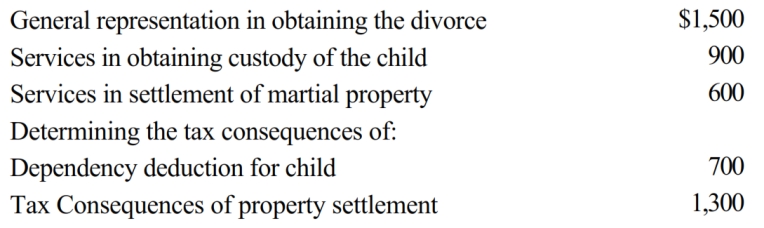

Velma and Bud divorced. Velma's attorney fee of $5,000 is allocated as follows:

Of the $5,000 Velma pays to her attorney in 2018, the amount she may deduct as an itemized deduction is:

Definitions:

Dual-Earner Couples

Households in which both partners have jobs and contribute to the family's income, a common economic arrangement in modern societies.

Multiple Roles

The concept of engaging in several distinct functions or social positions simultaneously.

Greater Resources

A term that refers to having more wealth, materials, or assets available for use or development.

Extramarital Sex

Sexual activities that occur outside of marriage.

Q14: While she was a college student, Angel

Q16: Olive, Inc., an accrual method taxpayer, is

Q23: The § 179 limit for a sports

Q31: Purchased goodwill must be capitalized, but can

Q35: Janet is the CEO for Silver, Inc.,

Q48: Judy paid $40 for Girl Scout cookies

Q73: Bruce, who is single, had the following

Q86: Martin is a sole proprietor of a

Q110: The amortization period for $58,000 of startup

Q120: Which of the following items, if any,