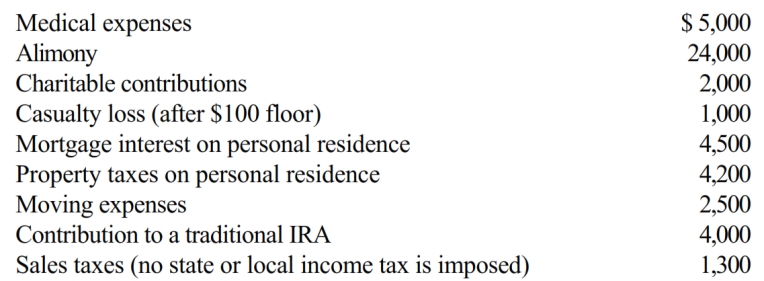

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during 2018:

Calculate Austin's deductions for AGI.

Definitions:

Debt

Money owed by one party to another, under conditions of repayment often including interest.

Book Value

The net value of a company's assets minus its liabilities, often used to assess a company's worth from a financial statement perspective.

Capital Accounts

Financial records that show the capital contributions, withdrawals, and earnings of owners in a company.

Cost of Capital

The rate of return a company must offer investors to entice them to invest, reflecting the risk of the investment alongside the return.

Q43: On their birthdays, Lily sends gift certificates

Q56: On June 2, 2017, Fred's TV Sales

Q74: Points paid by the owner of a

Q89: Wayne owns a 30% interest in the

Q91: The B & W Partnership earned taxable

Q93: If an automobile is placed in service

Q102: Qualified moving expenses of an employee that

Q111: Betty received a graduate teaching assistantship that

Q138: Alfred's Enterprises, an unincorporated entity, pays employee

Q145: Jacques, who is not a U.S. citizen,