Essay

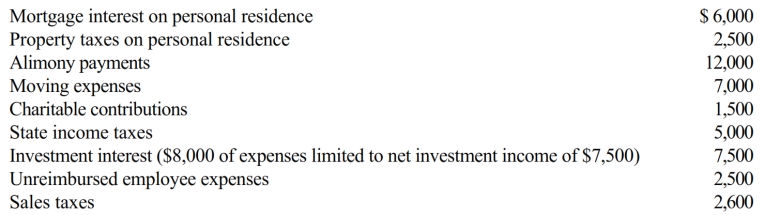

Arnold and Beth file a joint return in 2018. Use the following data to calculate their deduction for AGI.

Definitions:

Related Questions

Q34: Beginning in 2018, a personal casualty loss

Q34: The fact that the accounting method the

Q38: When contributions are made to a traditional

Q77: In 2018, Theresa was in an automobile

Q79: Al contributed a painting to the Metropolitan

Q97: During the year, Victor spent $300 on

Q107: Once the more-than-50% business usage test is

Q115: In contrasting the reporting procedures of employees

Q150: During the year, Kim sold the following

Q172: Basic standard deduction