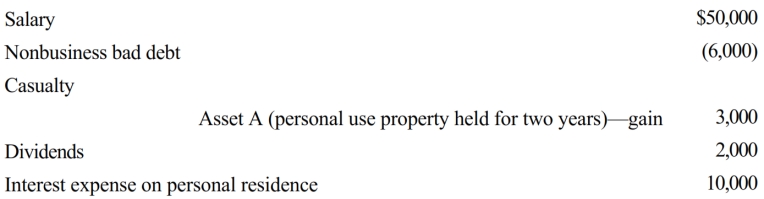

Mike, single, age 31, had the following items for 2018:

Compute Mike's taxable income for 2018.

Definitions:

Net Income

The total profit of a company after all expenses and taxes have been deducted from total revenues.

Income From Operations

Earnings generated from a company's regular business activities, excluding revenues and expenses from non-operating activities.

Sales

The total revenue generated from goods or services sold by a company during a specific period, indicating the primary source of business income.

Cost Of Goods Sold

Direct spending on materials and labor required to produce the merchandise a company sells.

Q12: Darryl, a cash basis taxpayer, gave 1,000

Q23: Sammy, age 31, is unmarried and is

Q53: A daughter-in-law who lives with taxpayer.

Q62: Harry and Wanda were married in Texas,

Q64: If a business retains someone to provide

Q73: Bruce, who is single, had the following

Q76: If a taxpayer can satisfy the three-out-of-five

Q97: During the year, Victor spent $300 on

Q99: Every year, Teal Corporation gives each employee

Q120: Sandra acquired a passive activity three years