Essay

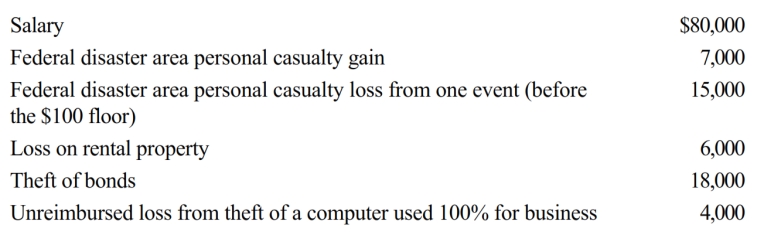

Gary, who is an employee of Red Corporation, has the following items for 2018:

Determine Gary's AGI and total amount of itemized deductions for 2018.

Definitions:

Related Questions

Q22: Pat gave 5,000 shares of stock in

Q39: After the automatic mileage rate has been

Q44: Gold Company was experiencing financial difficulties, but

Q57: Sharon made a $60,000 interest-free loan to

Q61: A taxpayer pays points to obtain financing

Q63: If a vacation home is a personal/rental

Q83: A major objective of MACRS is to:<br>A)

Q103: Sarah's employer pays the hospitalization insurance premiums

Q110: Kiddie tax applies

Q121: Sue does not work for other parties.