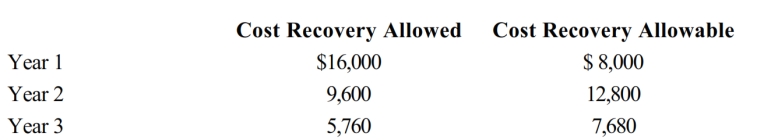

Tara purchased a machine for $40,000 to be used in her business. The cost recovery allowed and allowable for the three years the machine was used are computed as follows.

If Tara sells the machine after three years for $15,000, how much gain should she recognize?

Definitions:

Perpetual Budget

A continuously updated budget that adjusts and rolls over to subsequent periods as the financial year progresses.

Rolls Forward

A term used in accounting to describe the process of moving figures from one period to the next, often related to budgets or forecasts.

Budgets

Financial plans that outline expected revenues and expenditures for a specific period, guiding spending and investment decisions.

Bottlenecks

Restrictions in a production process that limit throughput, often leading to delays and reduced production efficiency.

Q13: In the case of an office in

Q40: When is a taxpayer's work assignment in

Q55: On July 17, 2018, Kevin places in

Q74: Discuss the criteria used to determine whether

Q91: Shirley sold her personal residence to Mike

Q93: For an activity classified as a hobby,

Q110: In 2018, Liam invested $100,000 for a

Q123: A deduction for parking and other traffic

Q139: Assuming an activity is deemed to be

Q143: Felicia, a recent college graduate, is employed