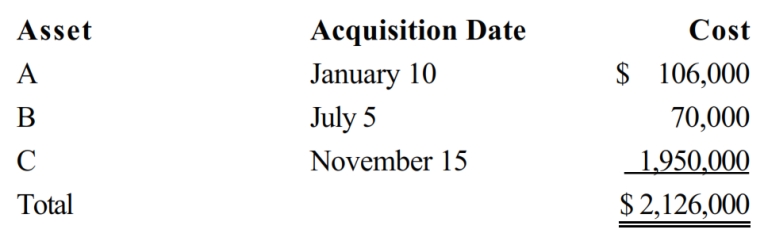

Audra acquires the following new five-year class property in 2018:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra does not claim any available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Participant Modeling

A behavior therapy in which an appropriate response to a feared stimulus is modeled in graduated steps and the client attempts to imitate the model step by step, encouraged and supported by the therapist.

Phobia Extinction

The process where a phobia diminishes or disappears after repeated exposure to the feared object or situation without any negative consequences.

Flooding

A psychological treatment method where a person is exposed to their fear at full intensity in order to help them overcome it.

Fear-Provoking Situation

A circumstance or setting that induces a response of fear or anxiety, often leading to avoidance or defensive behaviors.

Q5: Ed died while employed by Violet Company.

Q15: Brad, who uses the cash method of

Q23: The purpose of the tax credit for

Q24: During 2018, Kathy, who is self-employed, paid

Q60: A cash basis taxpayer must include as

Q70: Roger is in the 35% marginal tax

Q76: Nell sells a passive activity with an

Q114: On January 15, 2018, Dillon purchased the

Q115: The income of a sole proprietorship is

Q120: Which of the following depreciation conventions are