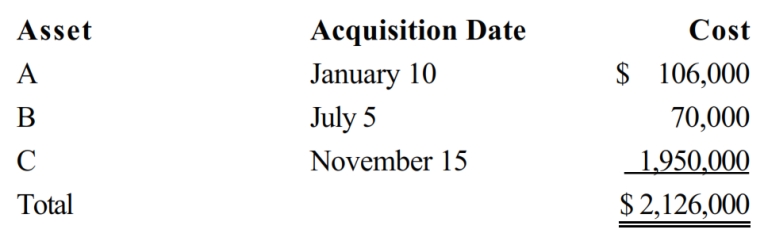

Audra acquires the following new five-year class property in 2018:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra does not claim any available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Fabricating Department

A section within a manufacturing facility where raw materials are transformed into components or products through various processes like cutting, assembling, or molding.

Weighted Average Method

An inventory valuation method that calculates the cost of goods sold and ending inventory based on the weighted average cost of all items available for sale.

Equivalent Units

A concept used in cost accounting to express the amount of materials, labor, and overhead costs associated with partially completed goods as if they were finished.

Weaving Department

A specialized division in a manufacturing facility where threads are interlaced to make textiles or fabric.

Q8: "Other casualty" means casualties similar to those

Q17: A taxpayer who maintains an office in

Q17: If an activity involves horses, a profit

Q30: Deductions are allowed unless a specific provision

Q33: Determine the proper tax year for gross

Q47: Tonya owns an interest in an activity

Q48: The taxpayer incorrectly took a $5,000 deduction

Q64: Alice purchased office furniture on September 20,

Q72: The work-related expenses of an independent contractor

Q88: For the past several years, Jeanne and