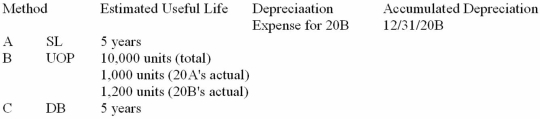

Duval Company acquired a machine on January 1,20A,that cost $2,700 and had an estimated residual value of $200.Complete the following schedule using the three methods of depreciation: A.)straight-line,B.)units-of-production,C.)declining-balance at 150% acceleration rate.

Definitions:

Intentional Deceit

Deliberate misrepresentation or withholding of truth to deceive or mislead another party, resulting in harm or damages.

Analysts' Conflicts

Situations where financial analysts' personal interests or relationships conflict with the professional advice they provide, potentially leading to biased information.

New York Stock Exchange

A leading global financial exchange for buying and selling stocks, located in New York City.

Investment Banking

A sector of the banking industry that deals with capital creation for other companies, governments, and other entities.

Q3: Generosity and honesty are characteristics of effective

Q23: Usability refers to five aspects of a

Q30: For most employers, communication skills are less

Q35: Assume the 20D income statement reported total

Q36: Travis Company reported a profit for 20B

Q44: The cost of goods available for sale

Q68: In 20B,Gamma Company made an ordinary repair

Q75: A company cannot use an inventory costing

Q124: Analysts play a major role in making

Q136: The apportionment of the acquisition cost of