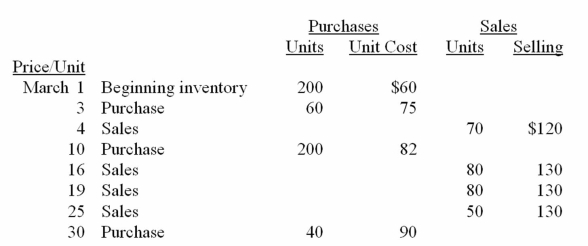

Richardson Ltd.sells many products.Hela is one of its popular items.Below is an analysis of the inventory purchases and sales of Hela for the month of March.Richardson uses the perpetual inventory system.

Requirements:

(a)Using the FIFO cost formula,calculate the amount of the cost of goods sold for March.(Show calculations)

(b)Using the average cost formula,calculate the amount of the ending inventory on March 31.(Show calculations)

(a)FIFO

(a)FIFO

Definitions:

Corporate Tax System

The legal framework governing how businesses are taxed by the government on their profits, varying significantly between countries.

Early Income

Revenue or earnings generated before the usual or expected time, often within a fiscal period.

Capital Gains

The profit from the sale of assets such as stocks, bonds, or real estate, which exceeds the original purchase price.

Preferential Tax Treatment

Financial policies or regulations that reduce tax rates or alter tax policies in favor of certain businesses, industries, or transactions.

Q7: Pied Piper Pies has been in business

Q53: Profit is first made public in press

Q53: Give the journal entries for the transactions

Q58: Quarterly reports are most likely unaudited and

Q65: G Co.,which is a biotechnology firm,reported the

Q72: Which of the following would appear in

Q78: Which of the following would be classified

Q108: What is an extraordinary repair to a

Q113: The secondary quality--comparability-assumes which of the following?<br>A)users

Q134: Recording depreciation expense does which of the