The Upton Country Store had the following transactions in April:

a.Sold $25,000 of goods to customers and received $22,000 in cash and the rest are on account

b.The cost of the inventory sold was $13,000

c.The store purchased $8,000 of inventory and paid for $4,000 in cash and the rest were bought on account

d.They paid $7,000 in wages for the month

e.Received a $600 bill for utilities for the month that will not be paid until May

f.Received rent for the adjacent store front for the months of April and May in the amount of $3,000

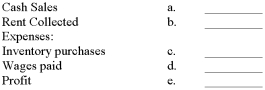

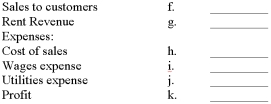

Complete the following statements:

Cash Basis

Income Statement

Revenues:

Accrual Basis

Income Statement

Revenues:

Definitions:

Accumulated Depreciation

The cumulative total of depreciation costs apportioned to a tangible asset since its initial operation.

Depreciation Expense

The allocated portion of an asset's cost expensed each year over its useful life to account for its wear and tear, obsolescence, or decline in value.

End-Of-Period Spreadsheet

A tool used in accounting to compile all balances and adjustments of an accounting period before preparing the final financial statements.

Retained Earnings

The portion of net income that is held by a company and not distributed to shareholders as dividends, used for investment or debt repayment.

Q15: A quality of earnings ratio higher than

Q21: A callable bond grants the option to

Q29: Why is the statement of cash flows

Q70: Which of the following represents the shares

Q75: Liabilities are generally classified on a statement

Q88: Which of the following statements is true?<br>A)Common

Q95: The payment of a liability in cash

Q105: By expressing profit on a per share

Q106: The difference between the equipment account balance

Q109: Air Cargo Company recorded the following adjusting