Rocky has a full-time job as an electrical engineer for the city utility. In his spare time, Rocky repairs electronic gear in the basement of his personal residence. Most of his business comes from friends and referrals from former customers, although occasionally he runs an ad in the local suburbia newspaper. Typically, the items are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

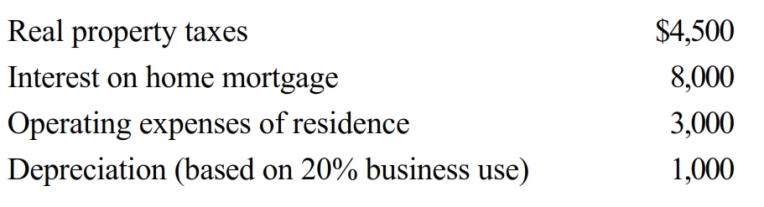

The floor space of Rocky's residence is 2,500 square feet, and he estimates that 20% of this is devoted exclusively to the repair business (i.e., 500 square feet). Gross income from the business is $13,000, while expenses (other than home office) are $5,000. Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business

a. If he uses the regular (actual expense) method of computing the deduction for office in the home?

b. If he uses the simplified method?

Definitions:

Poverty Line

A calculated income level used to determine who is considered poor, typically based on a family's total income and size, below which one is considered to live in poverty.

Poverty Rate

The proportion of a population living below the poverty line, indicating the level of economic deprivation in a society.

Conservative View

An economic philosophy that emphasizes free markets, limited government, and individual entrepreneurship as the keys to economic prosperity.

Charles Murray

A social scientist known for his controversial works on intelligence, education, and social structure in American society.

Q6: Hazel purchased a new business asset (five-year

Q15: Brad, who uses the cash method of

Q21: Taxpayer's home was destroyed by a storm

Q47: Section 1033 (nonrecognition of gain from an

Q64: Are all personal expenses disallowed as deductions

Q68: Expenses that are reimbursed by a taxpayer's

Q79: During the current year, Ryan performs personal

Q98: Tan Company acquires a new machine (ten-year

Q119: In 2017, Gail had a § 179

Q172: If the recognized gain on an involuntary