Essay

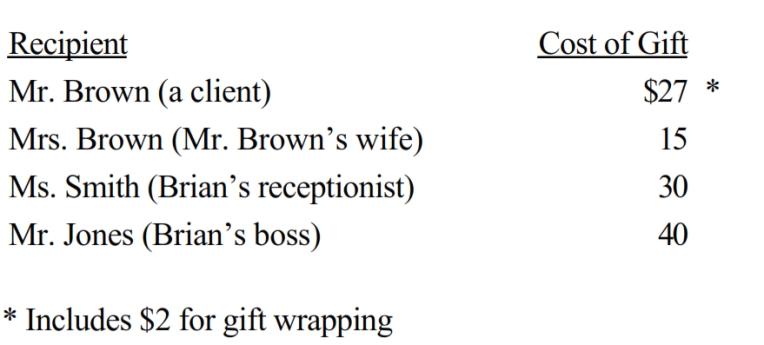

Brian makes gifts as follows:

Presuming adequate substantiation and no reimbursement, how much may Brian deduct?

Definitions:

Cash Dividends

Distributions of a company's earnings to its shareholders in the form of cash.

Related Questions

Q9: Mary incurred a $20,000 nonbusiness bad debt

Q12: The inclusion amount for a leased automobile

Q13: Pat purchased a used five-year class asset

Q17: Diane purchased a factory building on April

Q19: Linda owns investments that produce portfolio income

Q19: Graham, a CPA, has submitted a proposal

Q49: Qualifying tuition expenses paid from the proceeds

Q83: Only married taxpayers with children are qualified

Q138: When using the automatic mileage method, which,

Q248: If property that has been converted from