Rocky has a full-time job as an electrical engineer for the city utility. In his spare time, Rocky repairs electronic gear in the basement of his personal residence. Most of his business comes from friends and referrals from former customers, although occasionally he runs an ad in the local suburbia newspaper. Typically, the items are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

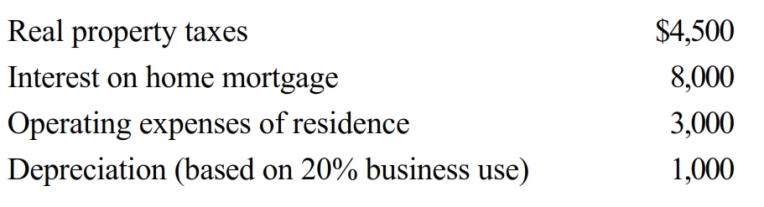

The floor space of Rocky's residence is 2,500 square feet, and he estimates that 20% of this is devoted exclusively to the repair business (i.e., 500 square feet). Gross income from the business is $13,000, while expenses (other than home office) are $5,000. Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business

a. If he uses the regular (actual expense) method of computing the deduction for office in the home?

b. If he uses the simplified method?

Definitions:

Entrepreneurial Mindset

A way of thinking that enables individuals to overcome challenges, learn from failures, and innovate in their pursuit of new opportunities.

Knowing Who

Understanding the key people within a network who can provide support, expertise, or resources that are instrumental for achieving goals or furthering an initiative.

Knowing What

The understanding of facts, information, and skills acquired through experience or education.

Behavior-focused Strategies

Approaches in management or marketing that concentrate on influencing or understanding human behavior.

Q2: The maximum credit for child and dependent

Q3: When a nonbusiness casualty loss is spread

Q27: Treatment of a sale of a passive

Q50: Interest paid or accrued during 2018 on

Q63: Material participation.

Q67: An individual generally may claim a credit

Q79: Sue was trained by Lynn.

Q90: Under the right circumstances, a taxpayer's meals

Q96: The cost recovery period for 3-year class

Q282: The surrender of depreciated boot (fair market