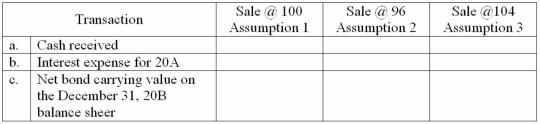

On June 30,20A,Reagan Corporation sold (issued)a $1,000,ten-year,8% bonds payable (interest payable each June 30 and December 31).

For the three assumptions below,complete the following schedule assuming the accounting year ends December 31,and straight-line depreciation is used:

Definitions:

Heterogeneous Expectations

A financial theory assumption that different investors have varied predictions about future market or asset performance.

Holding Period

The duration between the purchase and sale of a security or investment.

Price Takers

Parties in a market who accept prevailing prices because they have no power to influence the market price due to their small scale of operations or the competitive nature of the market.

Capital Gains

The amount by which the sale price of a security exceeds the purchase price.

Q2: A Co,a biotechnology company,reported cost of goods

Q8: What type of argument states that a

Q11: Which of the following statements about treasury

Q18: crafting a persuasive argument involves six tasks.

Q22: The following passage would be appropriate for

Q35: Current liabilities are short-term obligations that will

Q77: The end of period adjusting entry required

Q94: Liquidity refers to the ability of a

Q133: The amortization of a bond discount results

Q144: The carrying amount of a bond not