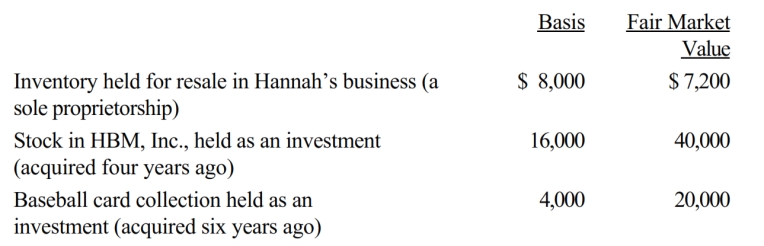

Hannah makes the following charitable donations in the current year:

The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

Definitions:

Feeling

An emotional state or reaction to stimuli, often subjective and not always based on fact.

Behaving

Acting in a manner according to certain standards, rules, or expectations in social contexts.

Heteronomous Morality

The first stage of moral development in Piaget’s theory, occurring from 4 to 7 years of age. Justice and rules are conceived of as unchangeable properties of the world, beyond the control of people.

Immanent Justice

The belief, often held by children, that moral behavior is immediately rewarded and immoral behavior is immediately punished.

Q36: Discuss the tax implications of a seller

Q63: In which, if any, of the following

Q65: On July 10, 2018, Ariff places in

Q73: Discuss the tax consequences of listed property

Q101: In 2018, Boris pays a $3,800 premium

Q108: Simpson Company, a calendar year taxpayer, acquires

Q128: During the current year, Ethan performs personal

Q129: Dick participates in an activity for 90

Q206: Abby sells real property for $300,000. The

Q233: Ken is considering two options for selling