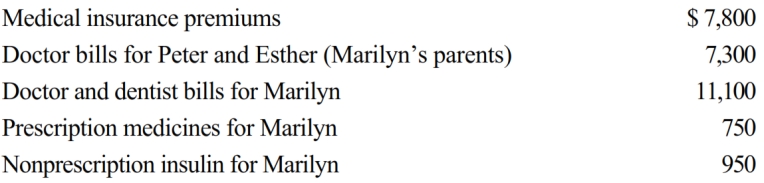

Marilyn, age 38, is employed as an architect. For calendar year 2018, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them. Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2018 and received the reimbursement in January 2019. What is Marilyn's maximum allowable medical expense deduction for 2018?

Definitions:

Barbados

An island country in the Lesser Antilles of the West Indies, known for its beaches, history, and cultural heritage.

Landholdings

Properties or parcels of land owned by an individual, a collective, or an institution.

Slave Systems

The organized and institutionalized practice of owning humans as property for the purpose of forced labor, prevalent in many societies historically, notably in the Americas.

European Colonies

Territories acquired and governed by European powers, often overseas, where they exploited resources and imposed their control over indigenous populations.

Q11: Frank established a Roth IRA at age

Q26: In 2018, Wally had the following insured

Q34: All personal property placed in service in

Q44: Rachel is single and has a college

Q46: Jake performs services for Maude. If Maude

Q71: Myra's classification of those who work for

Q81: In the current year, Don has a

Q87: Jackson Company incurs a $50,000 loss on

Q158: Nancy gives her niece a crane to

Q201: Paula inherits a home on July 1,