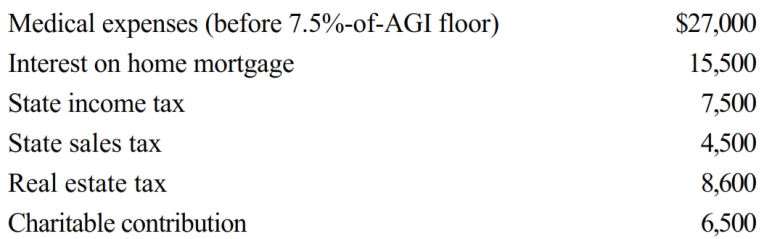

George is single and age 56, has AGI of $265,000, and incurs the following expenditures in 2018.

What is the amount of itemized deductions George may claim?

Definitions:

Type A Behaviour

A personality pattern characterized by high levels of competitiveness, self-imposed stress, impatience, and aggression.

Ambition

A strong desire to achieve success or distinction, often requiring determination and hard work.

Competitiveness

A state or quality that denotes how effectively an entity (such as a person, company, or country) can outperform rivals in a given market or area.

Negative Affectivity

A personality trait characterized by a pervasive tendency to experience negative emotions such as fear, sadness, and anger.

Q7: Five years ago, Tom loaned his son

Q8: A taxpayer who uses the automatic mileage

Q54: Realized gain or loss is measured by

Q59: Jim's employer pays half of the premiums

Q62: On February 1, 2018, Tuan withdrew $15,000

Q63: Peggy uses a delivery van in her

Q108: In addition to other gifts, Megan made

Q115: Lindsey, an attorney, earns $125,000 from her

Q128: The basis for depreciation on depreciable gift

Q210: The terms "realized gain" and "recognized gain"