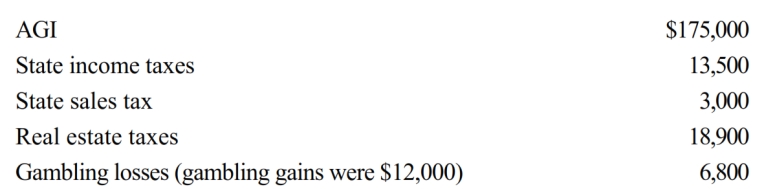

Paul, a calendar year single taxpayer, has the following information for 2018:

Paul's allowable itemized deductions for 2018 are:

Definitions:

Personal Error Patterns Chart

A tool used to track and analyze individual mistakes over time, often used in learning and development contexts.

Proofread

The process of reviewing text for errors before finalizing or publishing, focusing on correcting grammatical, punctuation, spelling, and formatting mistakes.

Awareness

The state or ability to perceive, feel, or be conscious of events, objects, or sensory patterns.

Error Pattern

A recurring or systematic mistake in data, behavior, or processes, often identified for purposes of correction or improvement.

Q24: Lynn purchases a house for $52,000. She

Q25: Discuss the reason for the inclusion amount

Q33: Paula owns four separate activities. She elects

Q39: After the automatic mileage rate has been

Q49: Gray Company, a closely held C corporation,

Q73: An education expense deduction may be allowed

Q92: Tom, whose MAGI is $40,000, paid $3,500

Q99: In applying the $1 million limit on

Q115: Lindsey, an attorney, earns $125,000 from her

Q253: Nontaxable stock dividends result in no change