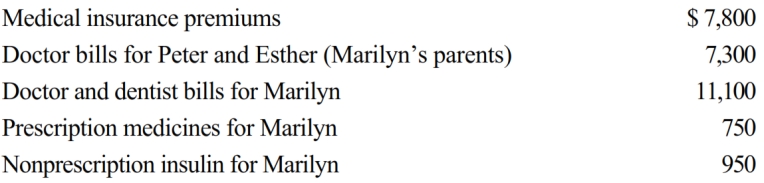

Marilyn, age 38, is employed as an architect. For calendar year 2018, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them. Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2018 and received the reimbursement in January 2019. What is Marilyn's maximum allowable medical expense deduction for 2018?

Definitions:

Sample Points

Individual data points or observations selected from a population for the purpose of statistical analysis.

Permutation

In an experiment we may be interested in determining the number of ways n objects may be selected from among N objects when the order in which the n objects are selected is important. Each ordering of n objects is called a permutation and the total number of permutations of N objects taken n at a time is PNn = n! / (N - n)! for n = 0, 1, 2, . . . , N.

Union

In mathematics, specifically in set theory, the union of a collection of sets is the set of all distinct elements that are in any of those sets.

Intersection

A mathematical term describing the point or set of points where two lines, curves, shapes, or surfaces meet.

Q12: In some cases it may be appropriate

Q29: Regarding research and experimental expenditures, which of

Q38: If a taxpayer has a business with

Q62: Myrna's personal residence (adjusted basis of $100,000)

Q71: Abner contributes $2,000 to the campaign of

Q108: In addition to other gifts, Megan made

Q115: If a husband inherits his deceased wife's

Q125: Vail owns interests in a beauty salon,

Q220: A realized gain on the sale or

Q284: The basis of personal use property converted