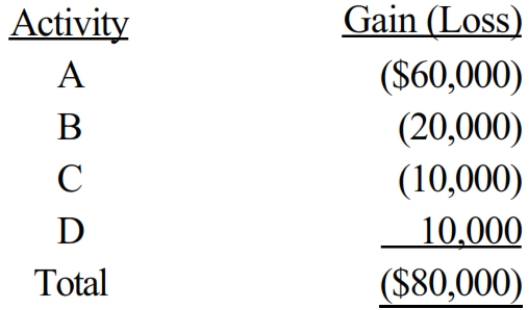

Hugh has four passive activities which generate the following income and losses in the current year.

How much of the $80,000 net passive activity loss can Hugh deduct this year? Calculate the suspended losses (by activity).

Definitions:

Rights Offering

A method by which a company raises capital by giving its existing shareholders the right to purchase additional shares directly from the company at a specified price within a set time.

Record Date

The specified date on which a company determines the shareholders eligible to receive a dividend or distribution.

Ex-rights Date

The ex-rights date is the first trading day when the buyer of a stock is not entitled to receive a previously declared rights offering, often leading to a decrease in the stock's price.

Venture Capital

Venture capital is financing provided to startups and small businesses with strong growth potential by investors seeking high returns.

Q19: The ceiling amounts and percentages for 2018

Q29: Describe the withholding requirements applicable to employers.

Q47: Tonya owns an interest in an activity

Q73: Michael is in the business of creating

Q88: The tax benefits resulting from tax credits

Q92: Molly exchanges land (adjusted basis of $85,000?

Q143: Felicia, a recent college graduate, is employed

Q149: In computing the amount realized when the

Q252: The taxpayer owns stock with an adjusted

Q270: Matt, who is single, sells his principal