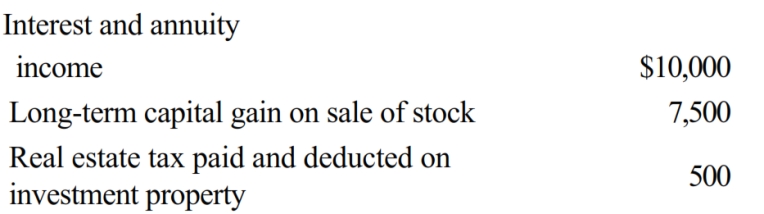

Barb borrowed $100,000 to acquire a parcel of land to be held for investment purposes and paid interest of $11,000 on the loan. She has AGI of $75,000 for the year. Other items related to Barb's investments include the following:

a. Determine Barb's current investment interest deduction, assuming she does not make any special election regarding the computation of investment income.

b. Discuss the treatment of Barb's investment interest that is disallowed in the current year.

c. What election could Barb make to increase the amount of her current investment interest deduction?

Definitions:

Unspoken Guidelines

Unspoken guidelines refer to implicit rules or norms that are understood and followed within a group or society without being formally communicated.

Mission Statement

A broad description of a firm’s objectives and the scope of activities it plans to undertake; attempts to answer two main questions.

Buying Center

A group of individuals within an organization who are involved in the decision-making process for making a purchase.

Buyer

The buying center participant who handles the paperwork of the actual purchase.

Q19: Georgia contributed $2,000 to a qualifying Health

Q25: Diane contributed a parcel of land to

Q34: All personal property placed in service in

Q35: Which of the following expenses, if any,

Q36: Hannah makes the following charitable donations in

Q92: Tom, whose MAGI is $40,000, paid $3,500

Q154: Under the taxpayer-use test for a §

Q254: Betty owns a horse farm with 500

Q272: Sam and Cheryl, husband and wife, own

Q281: Gift property (disregarding any adjustment for gift