Summer Corporation's business is international in scope and is subject to income taxes in several countries.

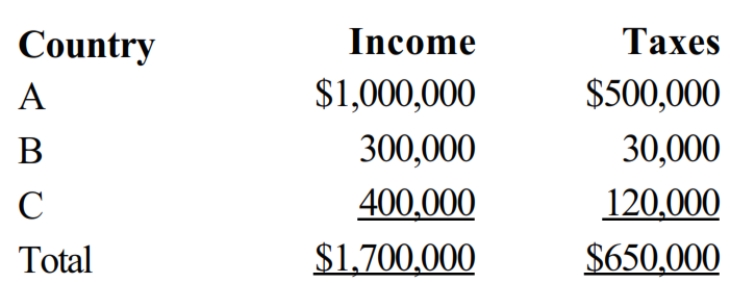

Summer's earnings and income taxes paid in the relevant foreign countries are:

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S. income tax due prior to the foreign tax credit is $504,000, compute the allowable foreign tax credit. If, instead, the total foreign income taxes paid were $250,000, compute the allowable foreign tax credit.

Definitions:

Fiduciary Responsibility

The obligation to act in the best interest of another party, such as a trustee acting for the benefit of the trust's beneficiaries.

Prudently

Acting with or showing care and thought for the future, often within the context of managing finances or making financial decisions.

Q31: Why is it generally undesirable to pass

Q36: The tax credit for rehabilitation expenditures for

Q56: Jordan performs services for Ryan. Which, if

Q83: Mike is a self-employed TV technician. He

Q86: The maximum child tax credit under current

Q98: In determining the basis of like-kind property

Q102: Noah gave $750 to a good friend

Q118: Stanley operates a restaurant as a sole

Q141: Under the simplified method, the maximum office

Q145: Ryan has the following capital gains and