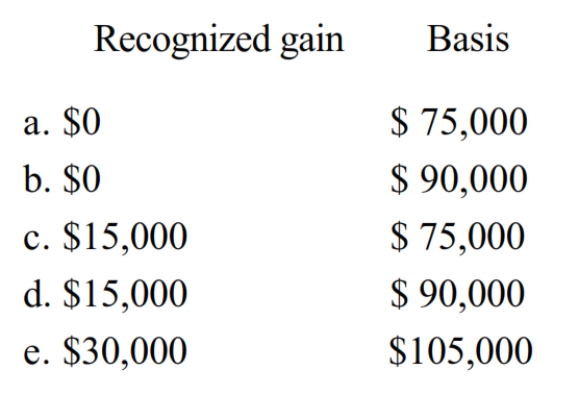

Nat is a salesman for a real estate developer. His employer permits him to purchase a lot for $75,000. The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Definitions:

Subordinate

An individual who is lower in rank or position and typically under the authority or command of another within an organizational hierarchy.

Direct Actions

Straightforward measures or movements made to achieve an objective without any intermediaries or deviations.

Indirect Actions

Indirect Actions refer to strategies or measures taken to achieve a goal or influence outcomes through means that are not straightforward or direct.

Visible Actions

Behaviors and activities that are observable by others, often used to demonstrate commitment or achievements.

Q15: Oriole Corporation has active income of $45,000

Q24: During 2018, Kathy, who is self-employed, paid

Q36: Jennifer gave her interest in a passive

Q39: In the case of a sale reported

Q62: Myrna's personal residence (adjusted basis of $100,000)

Q64: The amount received for a utility easement

Q78: In order to dissuade his pastor from

Q91: Active participation.

Q99: Black Company paid wages of $180,000, of

Q222: Ross lives in a house he received