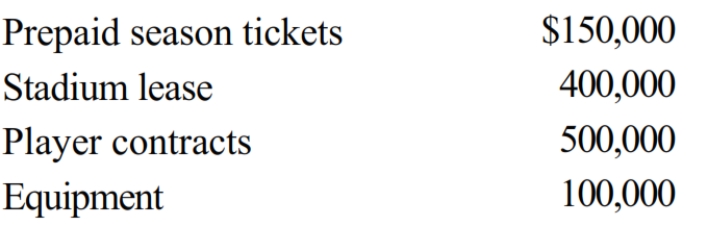

Marge purchases the Kentwood Krackers, a AAA level baseball team, for $1.5 million. The appraised values of the identified assets are as follows:

The Krackers have won the pennant for the past two years. Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

Definitions:

Current Liabilities

Obligations a company is expected to pay within a year, including accounts payable, short-term loans, and other short-term debts.

Common Size Income Statement

An income statement in which each line item is expressed as a percentage of sales, facilitating comparison across companies or periods regardless of size.

Cost Of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including material and labor expenses.

Sales

The total amount of goods or services sold by a company in a particular period of time.

Q16: Ahmad is considering making a $10,000 investment

Q27: Tanuja Singh is a CPA and operates

Q30: Dabney and Nancy are married, both gainfully

Q37: Which of the following decreases a taxpayer's

Q39: The basis for gain and loss of

Q46: Tara owns a shoe store and a

Q57: On September 18, 2018, Jerry received land

Q64: Ahmad owns four activities. He participated for

Q70: Bradley has two college-age children, Clint, a

Q81: Albatross, a C corporation, had $140,000 net