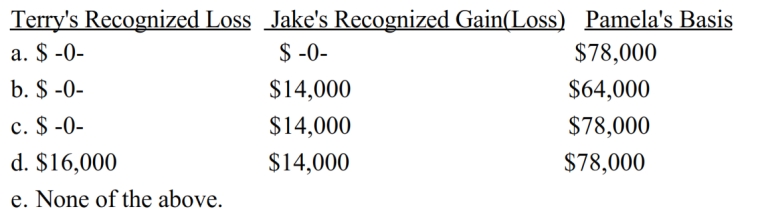

Terry owns Lakeside, Inc. stock (adjusted basis of $80,000), which she sells to her brother, Jake, for $64,000 (its fair market value). Eighteen months later, Jake sells the stock to Pamela, a friend, for $78,000 (its fair market value). What is Terry's recognized loss, Jake's recognized gain or loss, and Pamela's adjusted basis for the stock?

Definitions:

Desired Level of Growth

The desired level of growth is a target set by a business or organization for the expansion of its operations, sales, or market share over a specific period.

Daily Management Oversight

Continuous supervision of daily operations and activities within an organization to ensure efficiency and goal attainment.

Full Capacity

The maximum level of output that a company can sustain over a period of time without incurring unacceptable delays or costs.

Maximum Level of Sales

The highest amount of sales a company can achieve with its current resources and capacity before needing to expand.

Q3: Ben owns and operates as a sole

Q35: Tomas owns a sole proprietorship, and Lucy

Q66: Which of the following is incorrect?<br>A) The

Q67: Hal sold land held as an investment

Q74: Points paid by the owner of a

Q92: In the current year, Azul Corporation, a

Q107: The earned income credit is available only

Q114: Describe the circumstances in which the maximum

Q208: Morgan owned a convertible that he had

Q216: For each of the following involuntary conversions,