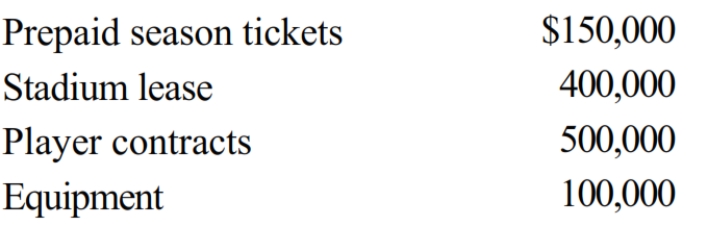

Marge purchases the Kentwood Krackers, a AAA level baseball team, for $1.5 million. The appraised values of the identified assets are as follows:

The Krackers have won the pennant for the past two years. Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

Definitions:

Terminating

The act of bringing something to an end or conclusion, often used in the context of contracts, employment, or processes.

Practice Budget

The financial plan for the operation of a medical practice, outlining the expected revenues and expenditures.

Revenues

Income generated from business activities or services before any expenses are deducted.

Expenses

Costs incurred in the operation of a business or the execution of a task.

Q2: Taylor inherited 100 acres of land on

Q10: Fred and Lucy are married, ages 33

Q17: Martha has both long-term and short-term 2018

Q43: The fair market value of property received

Q46: Juan refuses to give the bank where

Q48: Dena owns interests in five businesses and

Q59: If the taxpayer qualifies under § 1033

Q65: A taxpayer is considered to be a

Q205: Emma gives her personal use automobile (cost

Q270: Matt, who is single, sells his principal