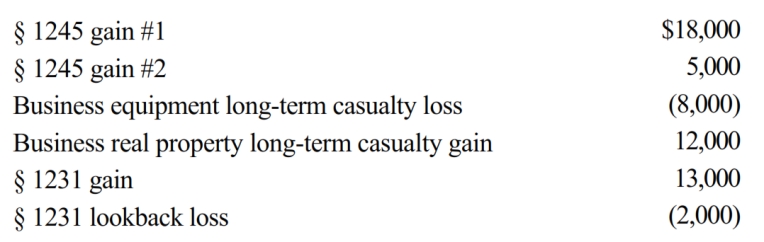

Betty, a single taxpayer with no dependents, has the gains and losses shown below. Before considering these transactions, Betty has $45,000 of other taxable income. What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Job Duties

Specific tasks and responsibilities that are expected to be performed by an individual holding a certain position.

Organizational Stakeholders

Individuals or groups that have an interest or stake in the success and outcomes of an organization, including employees, customers, suppliers, and investors.

Open Systems Anchor

A belief in organizational theory that emphasizes understanding organizations as open systems that interact with their environments, adaptable and influenced by external factors.

Values

Core beliefs or principles that guide an individual's actions and judgments and influence their behavior and attitudes.

Q30: An S corporation may select any tax

Q48: In the case of an accrual basis

Q51: When a taxpayer transfers property subject to

Q53: Eve transfers property (basis of $120,000 and

Q55: In 2018, Beth sold equipment used in

Q103: A personal service corporation must use a

Q109: An employee with outside income may be

Q141: Expenditures made for ordinary repairs and maintenance

Q174: What effect does a deductible casualty loss

Q205: Emma gives her personal use automobile (cost