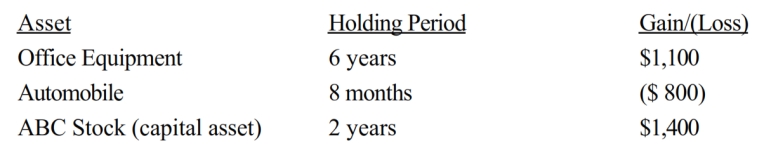

The following assets in Jack's business were sold in 2018:

The office equipment had a zero adjusted basis and was purchased for $8,000. The automobile was purchased for $2,000 and sold for $1,200. The ABC stock was purchased for $1,800 and sold for $3,200. In 2018 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

Definitions:

Warranty Repairs

Services provided to repair or fix products covered under a warranty at no charge to the customer, typically within a specified time period after purchase.

Estimated Premium Claims

The projected claims that an insurance company expects to pay out based on the premiums it has received.

Coupons Redeemed

The act of exchanging a coupon for a discount, product, or service, usually part of a promotional offering.

Premium Expense

The cost associated with purchasing an insurance policy or the amount over the face value paid for a bond or stock.

Q2: A long-term note is treated as "boot."

Q11: Steve records a tentative general business credit

Q36: Ivory Fast Delivery Company, an accrual basis

Q51: Bob and Sally are married, file a

Q79: Grebe Corporation, a closely held corporation that

Q101: Susan generated $55,000 of net earnings from

Q145: Distributions by a corporation to its shareholders

Q146: Violet, Inc., has a 2018 $80,000 long-term

Q153: Section 1231 property generally does not include

Q269: Broker's commissions, legal fees, and points paid