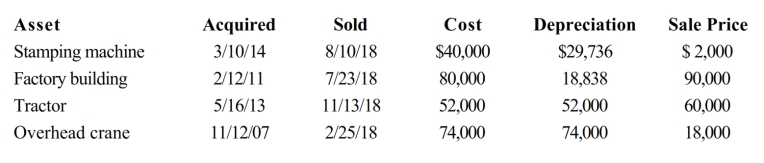

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship) this year. Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year. Assume there is a § 1231 lookback loss of $14,000.

Definitions:

Investment Plan

A financial strategy plotted for making investments in various assets with the goal of achieving specific financial objectives.

Inherited Annuity

A financial product received as part of an inheritance, providing periodic payments that were initially purchased by a deceased individual.

Equal Annual Amounts

A method of loan repayment or investment that involves paying or receiving the same amount of money each year.

Present Value

The value today of a future sum of money or sequence of cash payments, calculated using a specific return rate.

Q20: A factory building owned by Amber, Inc.

Q21: Seven years ago, Eleanor transferred property she

Q51: Ramon is in the business of buying

Q57: Dawn, a sole proprietor, was engaged in

Q69: Harry and Wilma are married and file

Q81: In 2017, Juan and Juanita incur $9,800

Q135: Wyatt sells his principal residence in December

Q154: Under the taxpayer-use test for a §

Q261: Cole exchanges an asset (adjusted basis of

Q265: Capital recoveries include:<br>A) The cost of capital