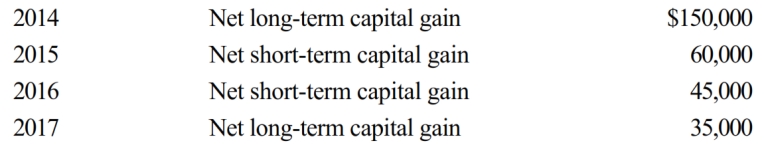

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2018. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:  Compute the amount of Carrot's capital loss carryover to 2019.

Compute the amount of Carrot's capital loss carryover to 2019.

Definitions:

Distributing

The act of sharing or spreading something among multiple recipients.

Made Presentations

The act of delivering a speech or lecture on a specific topic to an audience.

Electronically

Pertaining to technology or devices that operate on electricity and involve the use of computer systems or electronic circuits.

Matches

Items that correspond or are identical in some way, often referring to games where opponents are paired off or things that are similar.

Q14: Which of the following taxpayers is eligible

Q29: Jillian, a single taxpayer, has a net

Q41: Don, the sole shareholder of Pastel Corporation

Q69: Explain whether shareholders are exempted from gain/loss

Q70: The terms "earnings and profits" and "retained

Q79: Wren Corporation (a minority shareholder in Lark

Q138: Stephanie is the sole shareholder and president

Q163: The BMR LLC conducted activities that were

Q183: Ivory Corporation (E & P of $1

Q275: Robert sold his ranch which was his