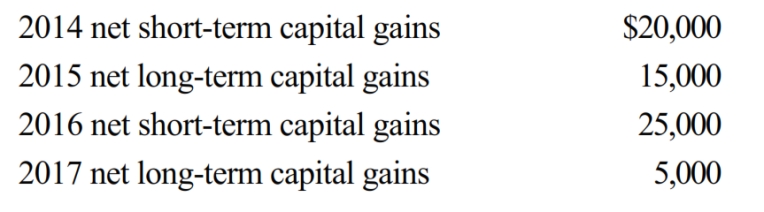

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2018. Ostrich also has taxable income from other sources of $1 million. Prior years' transactions included the following:

a. How are the capital gains and losses treated on Ostrich's 2018 tax return?

b. Determine the amount of the 2018 net capital loss that is carried back to each of the previous years.

c. Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d. If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2018 tax return?

Definitions:

Children At Risk

Refers to minors who are exposed to a higher likelihood of experiencing negative outcomes such as abuse, neglect, or educational disadvantages.

Firearm Injury

Physical harm or damage caused by a gun or firearm, including both intentional and accidental incidents.

Obese

A health disorder marked by an abundance of body fat which poses risks to well-being.

Responsible

Being accountable or answerable for one's actions or decisions.

Q18: Albert is in the 35% marginal tax

Q27: Abby sold her unincorporated business which consisted

Q33: Taylor, a single taxpayer, has taxable income

Q47: Alan, an Owl Corporation shareholder, makes a

Q54: A distribution from a corporation will be

Q58: Acquiring Corporation transfers $500,000 stock and land

Q82: Jambo invented a new flexible cover for

Q102: In the current year, Carnation Corporation has

Q143: Which one of the following statements is

Q222: DDP Partnership reported gross income from operations