Warbler Corporation, an accrual method regular corporation, was formed and began operations on March 1, 2018.

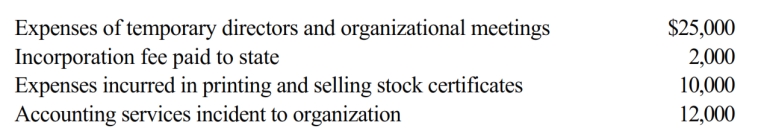

The following expenses were incurred during its first year of operations (March 1 - December 31, 2018):

a. Assuming a valid election under § 248 to amortize organizational expenditures, what is the amount of Warbler's deduction for 2018?

b. Same asa., except that Warbler also incurred in 2018 legal fees of $15,000 for the drafting of the corporate charter and bylaws. What is the amount of Warbler's 2018 deduction for organizational expenditures?

Definitions:

Cranial Nerves

Peripheral nerves that originate from the brain.

Peripheral Nerves

Nerves located outside the brain and spinal cord that connect the central nervous system to limbs and organs, transmitting signals to and from the body.

Neuron

A specialized cell transmitting nerve impulses; a nerve cell, the fundamental unit of the nervous system with the ability to communicate information through electrical and chemical signals.

Nucleus

The central and most important part of an atom, cell, or structure, typically containing protons and neutrons in an atom or genetic material in a cell.

Q6: Sean, a sole proprietor, is engaged in

Q33: Taylor, a single taxpayer, has taxable income

Q42: Pedro, not a dealer, sold real property

Q43: Since debt security holders do not own

Q58: Dawn is the sole shareholder of Thrush

Q95: Constructive dividends do not need to satisfy

Q123: Milton owns a bond (face value of

Q154: In 2018, Satesh has $5,000 short-term capital

Q166: Additional first-year (bonus) depreciation deduction claimed in

Q215: SQRLY LLC has about 25 LLC members.