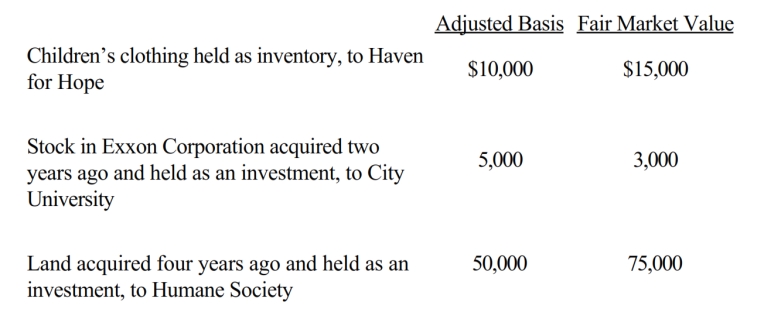

During the current year, Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

Definitions:

Glenohumeral Joint

The ball and socket joint between the head of the humerus and the glenoid cavity of the scapula, facilitating shoulder movement.

Lateral Excursion

The side-to-side movement of the mandible (lower jaw), which plays a key role in the process of chewing food.

Anatomical Position

A standardized stance in anatomy where the body is erect, facing forward, with arms at the sides and palms facing forward.

Opposition

Resistance or dissent, expressed in action or argument.

Q9: A partnership deducts all of its interest

Q16: Albert transfers land (basis of $140,000 and

Q56: Jared, a fiscal year taxpayer with a

Q77: The passive loss rules apply to closely

Q80: When property is contributed to a partnership

Q94: The rules used to determine the taxability

Q112: Renee, the sole shareholder of Indigo Corporation,

Q191: Mitch owns 1,000 shares of Oriole Corporation

Q192: If boot is received in a §

Q230: Which of the following is an election